BLUE OCEAN BLOG

BE INSPIRED.

BE BLUE OCEAN.

FEATURED ARTICLE

Kim and Mauborgne Honored as Two of the Four Leading Thinkers in Harvard Business Review’s 100-year Celebration

Patrick Bet-David: From $2 million to $250 million with Blue Ocean Strategy

How do you break out of the red ocean and create a blue ocean? That’s the precise question Patrick Bet-David (PBD) asked...

Taylor Swift: A Blue Ocean Strategist in the Entertainment Industry

Written by Melanie Pipino, an Institute Fellow at the INSEAD Blue Ocean Strategy Institute. Photo licensed under Creative...

Three Steps Towards Market Domination

The market dynamics of value innovation. No company wants perfect competition. It’s tough. There’s no money in it. Perfect...

The Benefits of Innovation That Isn’t Disruptive

Written by Chan Kim and Renée Mauborgne, with Mi Ji, Senior Executive Fellow at the INSEAD Blue Ocean Strategy...

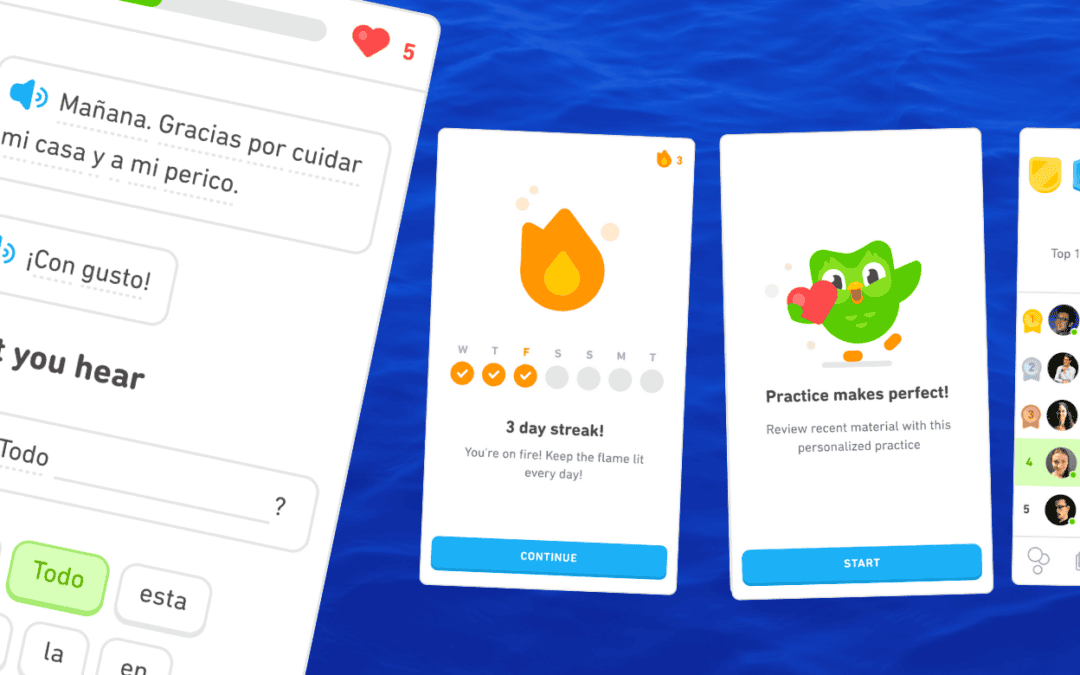

How Duolingo Gamified Language Learning to Revolutionize Online Education

By Oh Young KooInstitute Senior Executive Fellow at The INSEAD Blue Ocean Strategy Institute Have you ever attempted to...

BLUE OCEAN SPRINT with AI NAVIGATOR

Kickstart Your Growth, Break Free from Competition, and Redefine Your Market to Seize New Opportunities

Leverage the new AI Navigator, your superpowered Blue Ocean-trained partner in strategy and put it to work for your business.

“LOVED this course. No nonsense, 100% practical tools I can start implementing TODAY in my organisation!” Amalia C., Google

THE BLUE OCEAN STRATEGY PRACTITIONER PROGRAM

Transform your strategic perspective, master blue ocean tools and frameworks, & learn to unlock new growth opportunities

Get started with new market creation with our live, interactive, expert-led program.