BLUE OCEAN BLOG

BE INSPIRED.

BE BLUE OCEAN.

FEATURED ARTICLE

Kim and Mauborgne Honored as Two of the Four Leading Thinkers in Harvard Business Review’s 100-year Celebration

The Benefits of Innovation That Isn’t Disruptive

Written by Chan Kim and Renée Mauborgne, with Mi Ji, Senior Executive Fellow at the INSEAD Blue Ocean Strategy...

Artificial Intelligence on the Runway

Written by Melanie Pipino, an Institute Fellow at the INSEAD Blue Ocean Strategy Institute. Image created by OpenAI's...

What Innovators Who Create New Markets Do Differently

For decades, the business and corporate world has been sold on three ideas: One, we should analyze what is, to shape our...

A Nondisruptive Approach to the Environment

Written by Chan Kim and Renée Mauborgne, with Mi Ji, Senior Executive Fellow at the INSEAD Blue Ocean Strategy...

Five Key Insights for Positive-Sum Innovation

Our new book, Beyond Disruption – Innovate and Achieve Growth Without Displacing Industries, Companies, or Jobs, is the...

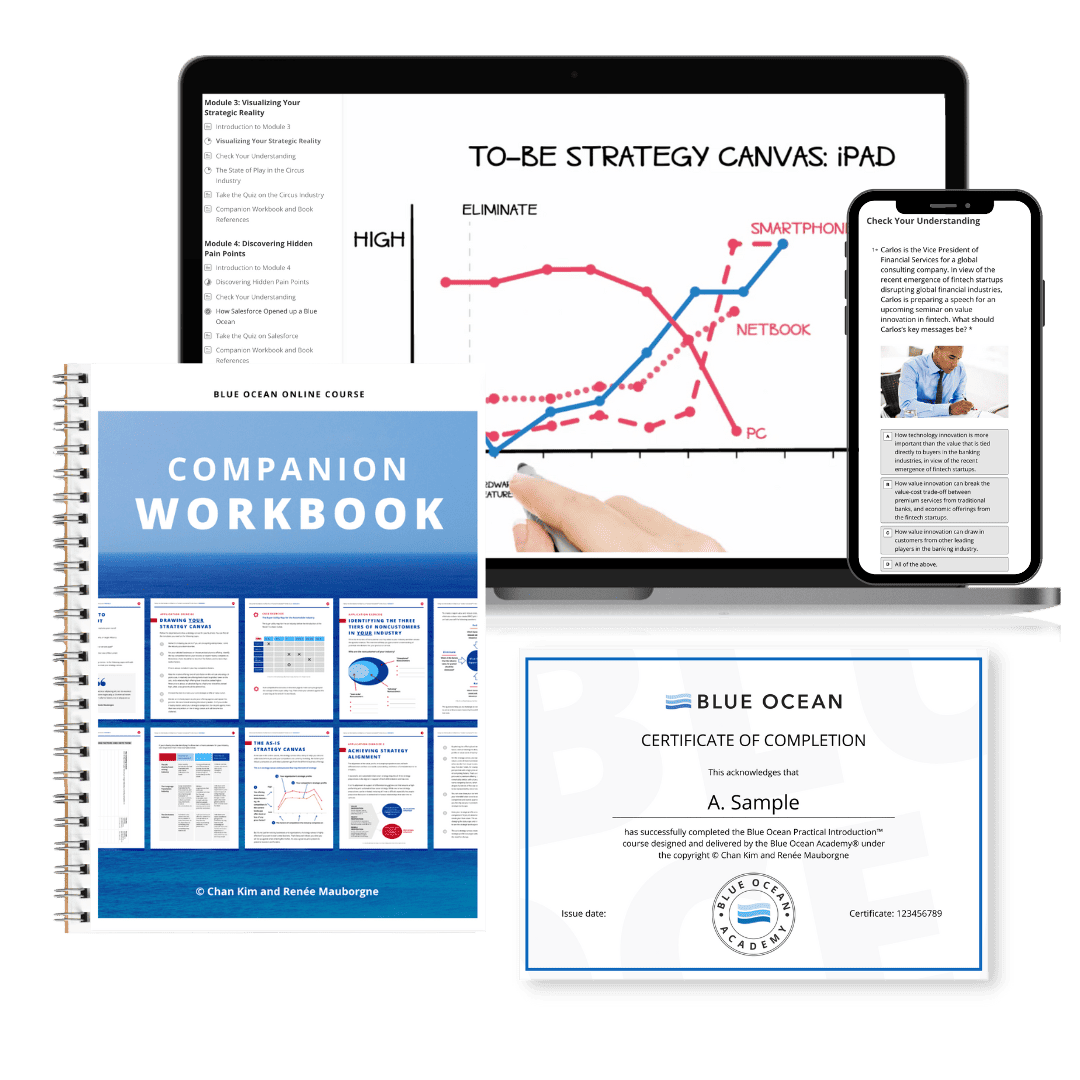

BLUE OCEAN SPRINT

Learn how to leave the competition behind. Discover how to create a new market space while lowering your costs, fast.

“LOVED this course. No nonsense, 100% practical tools I can start implementing TODAY in my organisation!” Amalia C., Google

Join thousands of leaders like you who are creating innovative companies, products, and services that stand out from the crowd.

THE BLUE OCEAN STRATEGY PRACTITIONER PROGRAM

Transform your strategic perspective, master blue ocean tools and frameworks, & learn to unlock new growth opportunities

Get started with new market creation with our live, interactive, expert-led program.